Cap Rates have been declining nearly 7.45% per year since 1984, from 12.02% to 3.63% in 2015, and we have been seeing lower as we negotiate M&A transactions for our customers.

Average PPSF prices have have been growing at a compound annual rate of 11.925% from Q4 2010 to Q4-2015 or a gross rate of 75.644% from 5 years ago: from $1,281 to $2,250/sqft.

52% of current residential developments are for $5MM+ units, followed by $1MM-$2MM units accounting for 15.6% of new development.

Real Estate Prices always go up! It is a statement that is conditionally correct—as long as your economy is driven by inflation, and was not always the case in the USA. But inflation is really just a fancy way of saying: we are expanding the money supply. As you have inflation hard assets like Real Estate prices, which are linked to inflation, goes up. If we dig deeper into this phenomenon we see that there is more to this. We live in a three dimensional universe with the fourth being time, and it is linear; so, how do other market factors impact real estate prices?

Correlation is a mutual relationship or connection between two or more things. When we buy real estate we usually look for a mortgage, or big companies just take out debt. To keep it simple, Fed Funds rates impact: US-Treasuries, Mortgages, Cost of Debt, etc. which in turn impact Capitalization Rates, or cap rates, which is the yield a building will provide to its investor.

Below we have a 30+ year historical chart of rates and treasury yields. What is interesting to note is that they are all “correlated”; some lagging more than others against the Federal Reserve’s actions. It is interesting to note that they are trending down at around 7.21% year (the blue trend line being cap rates), where when we look at Streeteasy’s Condo index, the prices of condos are trending UP at nearly the same rates of 6.91%!!

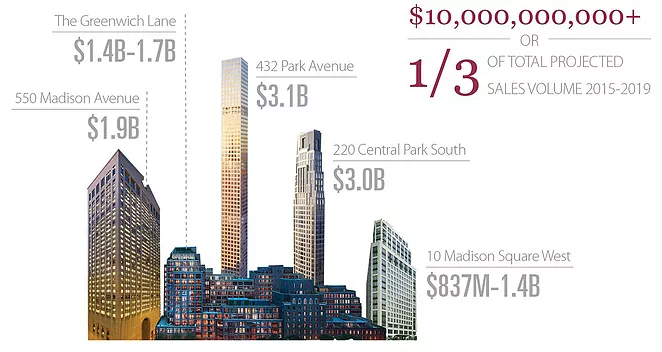

This decline encourages developers to develop and buyers to buy. As money becomes cheaper, companies can begin to take on greater risk, buyers can afford higher prices and in turn we see a real estate development boom! Below we have the current top-10 developers in Manhattan and their projects over the past 5 years--since: 2011. The grey is our assumptions based on current market pricing:

And as developers build, larger commercial units and better retail spaces, they are also building higher up. Most notably they are building larger and less affordable apartments:

With the Federal Reserve (at the time the fed chair was Ben Bernanke) lowering interest rates to 0%, developers know that this would only work in their favor. Yields, and the cost of debt, have an inverse relationship with price. As yields or mortgage rates drop the price per square foot and the price of buildings increases, as do the face values of bonds and treasuries. And we see the last major movement happen in mid-2012:

With rates at 0% since 2009, the 10-year yields in mid-2012 dropped from around 3.4% to 1.9%--the Avg. PPSF went from $1,530 to $2,271, which is a -48.4% drop in yield! This move change brought the recent increase in: Condo prices, the price per square foot of Office Space, retail spaces to price higher per square foot, etc. Cap rates for rental buildings compressed further as well, and from our own experience we are seeing prices fall below the 2.5% cap rate in many cases below our historical data sets. This has brought us to the realm of the negative leverage ratios, where the cost of debt is higher than the returns. Furthermore, we start to price buildings closer to core inflation levels, which are currently 2.2% making real returns, a challenge.

In short, the future of the market will depend on various factors but with the Fed trying to raise rates in the USA, and Europe not raising rates at all this year, we have to wait and see if any major movement will happen in the first half of 2016. We now are threatened by the concept of negative rates, which will only cause real estate prices to go up higher as cap rate compression continues. And this only happens because as yield becomes harder to find, assets like real estate have “real” value. If the market does reverse, real estate prices will take some time to adjust and investors will have to see their real estate returns from a “Total Return” point of view.